Bupa Dental Insurance

Get Dental Insurance for your business

Help your team take better care of their oral health with quick access to a dentist and cash back on their treatment costs.

Employees can choose to stay with their current practice or switch to a Bupa dentist and access even more benefits, such as:

- Instant Claim

- Discounts of up to 20%† on treatment costs

- Our dedicated Oral HealthLine for fast advice and booking guaranteed appointments

With over 360 Bupa dental practices across the UK, your people can get the care they need and get back to feeling and performing at their best.

If you're interested in Bupa Dental Insurance for your business, you can leave your details with us and we'll be in touch.

- [Presenter] Dental care is essential to staying healthy.

And when a dentist looks in our mouths, they don't just see our teeth and gums.

They can spot signs of more serious problems with your general health too.

So it's important to visit the dentist regularly.

And we've made it easier with Bupa Dental Insurance.

We'll contribute to the cost of treatments and provide comprehensive oral cancer cover a standard so you're covered even if the worst should happen.

At most of our practices, we can settle your claim at reception with our hassle-free Instant Claim service.

And you can enjoy up to 20% discount on treatments when you register with a Bupa Dental Care practice.

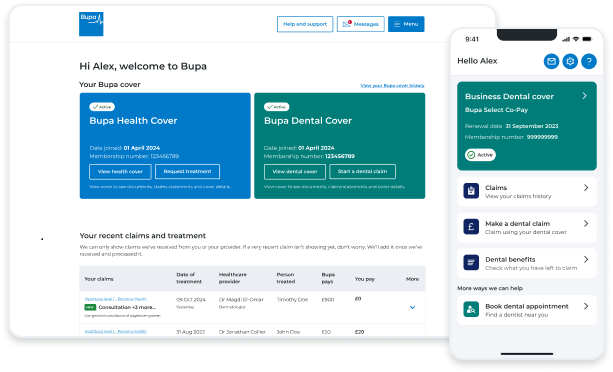

Managing your policy and submitting claims is easy with MyBupa.

And you can book appointments with our online finder tool, or Oral HealthLine.

You can even use your policy for virtual appointments.

And you'll be covered for dental emergencies and injuries wherever you are in the world.

And if you already have a dentist, you can keep using them too.

We can reimburse the cost of your treatment as far as your benefit allowance permits.

It's easy, flexible, and convenient, just the way dental cover should be.

Visit our website to find out more.

We offer coverage for any business size

No matter the size of your business, we can support you.

Small business

For businesses of 2-249 employees

Whether you're a start-up or a small business, we can help your employees with cash back towards dental treatment with Bupa Dental Insurance.

Corporate

For businesses with over 250+ employees

Be an employer of choice by offering Bupa Dental Insurance. Give back to your employees, whilst keeping your business thriving.

Already covered by Bupa Dental Insurance?

If you already have Bupa dental cover, you can use My Bupa to:

- view your policy details

- check your dental benefits

- Claim money back for treatment

Book a dental appointment

You can book your next routine examination or hygiene appointment online. With over 360 Bupa dental practices across the UK, help is never far away.

More information on treatments

Use our resources to help you check your symptoms or get help for any oral health concerns.

Dental advice and information

Find information on dental symptoms, pain and discomfort, and what treatments we offer.

Dental symptoms

Learn how to check symptoms in your teeth, mouth or jaw and when to seek professional help.

Dental treatments

We offer a wide range of treatments, from check-ups and cosmetic dentistry, to implants and oral surgery.

†You must tell the dentist you have Bupa dental insurance and provide your membership number prior to your appointment to benefit from this offer. 10% or 20% discounts are available depending on the practice and the dentist you are seeing. To find the selected Bupa owned and approved network dental practices where this offer is available, see finder.bupa.co.uk and search the Bupa Dental Insurance Network. Discount excludes laboratory fees and specialist treatment and cannot be used against NHS and Bupa Dental Essentials services. Discount cannot be used in conjunction with any other discount.

Bupa dental insurance is provided by the Bupa Insurance Limited. Registered in England and Wales with registration number 3956433 Bupa insurance limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Arranged and administered by Bupa Insurance Services Limited, which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales with registration number 3829851. Registered office: 1 Angel Court, London, EC2R 7HJ.