Member support

Make the most of your Bupa health insurance

From making a claim or checking your account, to getting an appointment, all the help you need is right here.

How can I make a claim?

If you need treatment and would like to make a claim, you’ll usually need to have visited your GP and received a referral. In some cases, you can submit a claim without a GP referral.

If your cover includes Direct Access, you can speak to us about some symptoms as soon as you’re worried. You may even be able to get treatment without seeing a GP.

When claiming, you’ll need your Bupa membership number as well as details about your diagnosis and treatment.

How to use your

health cover dental allowance

It’s easy to make the most of your new dental allowance.

Just book an appointment at a Bupa Dental Care practice and tell them your health insurance membership number. Any claims will come to us direct – there’s no need to call us first.

Transcript

How do I make a claim?

You can reach out to us directly to make a claim.

We may need some further information from yourself and your gp.

Depending on the nature of the claim,

it will determine how long it may take us to approve it.

How do I get the most out of my policy - if I don't need to claim?

You don't need to claim to

get the most out of your policy.

You can access our digital gps.

You can also use the Anytime Healthline,

and also you can access lots of content

and support through our inside health events

and through our websites.

Will you invoice me for my treatment?

Bupa won't invoice you for your treatment.

We will process and pay the claims that come in directly from the healthcare

provider,

and we will let you know whether that claim has been paid in full or where there

is an amount for you to pay.

But don't pay anything to the healthcare provider unless Bupa instruct you to do

so.

How do I know how much you have paid for my claim?

When we process and pay your claim,

we will write to you and let you know whether that claim's been paid in full or

whether there is an amount outstanding for you to pay.

Don't pay anything to the healthcare provider unless Bupa notify you.

Will I have to pay for any of my treatment?

There may be some things that Bupa don't cover the costs of, for example,

prescription drugs or dressings. And of course,

if there is an excess on your policy,

there may be an amount for you to pay in that instance.

Other scenarios may be when you've got an outpatient benefit limit,

and if you've gone over that, then it will be for you to pay.

How is a claim paid?

So claims are generally received into Bupa directly from your healthcare

provider. We will process and pay them direct.

If there's anything for you to pay such as an excess, we will notify you.

Am I covered if cancer comes back?

Yes. If you're covered with Bupa,

we will support you from day one as part of our cancer promise.

Do you ever get in touch with my GP?

Yes,

there will be times when we may need to get in touch with your GP to make sure

that we're getting the best guidance in terms of your health,

but rest assured we would never do that without your prior consent.

Can I choose which consultant or doctor I see?

So when you make a claim with us,

we'll be able to guide you to a consultant who's eligible on your cover.

Alternatively, you can look at our consultant and facilities finder,

and if the consultant you've got in mind is Bupa recognised,

then that should be okay.

Can you help with my child's mental health?

You can call our family mental health line for expert guidance on how to support

your child who may be experiencing symptoms of mental health.

Your child doesn't even need to be on your policy as long as their parent or

legal guardian is.

Which hospitals can I go to?

So it depends what hospitals are covered as part of your policy,

which you can view in your membership pack.

We do cover lots of private hospitals, private establishments, NHS,

wings and other facilities.

So just give us a call and we can talk you through it.

Am I covered for mental health treatment?

Yes, Bupa covers more mental health conditions than ever before,

and there are no time limits either. So as long as you're still covered with us,

if your mental health condition comes back,

then we should be able to support you.

Treatment may be eligible to certain benefit limits. For example,

if you've chosen an outpatient benefit limit, you need to be aware of that,

but you can check your membership policy documents online or the ones that we

sent you in the post. And if you can't locate your documents,

just give us a call and we can answer any questions that you may have.

Who are you?

Hi, my name's Kelly Holden. I'm a corporate account manager at Bupa.

Come and ask me your questions today about your health insurance and even what

you might be covered for.

Can I use my cover straight away?

As soon as your cover starts, you can speak

to a digital GP

or you can speak to one of our nurses on

the Anytime Health Line.

There's also lots

of health content available on our website that you can access.

If you do need to see someone, then just call us

to authorise this, and as long as your symptoms started

after your cover started, that should be okay.

In some cases, when you make a claim early on, we may need

to speak to your gp.

What is a platinum consultant?

Platinum consultants are covered by all of our healthcare policies and schemes.

They are fee assured,

which means that you won't get any unexpected bills to pay for your eligible

treatments. They're rated 97% good or excellent by Bupa patients,

and they're also part of our Open Referral Network.

You can find our consultant and facilities finder highlights our platinum

consultants on our website.

Can I get help or treatment at home?

If you do need treatment at home, then this will depend on

what your policy covers you for

and the symptoms that you're experiencing.

This will be assessed on a case by case basis,

and there may be occasions when we may not be able

to cover treatment at home.

What does fee assured mean?

Assured means that a consultant has agreed to work within bupa's rates.

It also means that you won't get any unexpected bills to pay once your treatment

has finished.

Can each person on my cover have different options of cover?

Yes, on your family policy, you don't all have to have the same cover options,

so it is tailored for everyone.

You can have different levels of cover within your family policy.

How do I book an appointment with a specialist after a GP referral?

To book an appointment with a specialist,

you can call us directly to pre authorise this.

We'll be able to check your symptoms and make sure that what you're claiming for

is covered.

Am I covered for physiotherapy?

Physiotherapy is covered, and that depends on your level of cover.

There are no limits to the number of sessions that you can have.

As long as this is medically necessary and within the benefit limits on your

policy, you may have an outpatient benefit limits,

and this can be viewed in your membership guide.

Bupa also covers some alternative therapies, for example,

osteopathy and chiropractic.

Am I covered for cancer treatment?

Yes, Bupa has Cancer Promise.

As long as you have cancer cover on your Bupa policy. If you have cancer,

Bupa will support you from diagnosis to treatment.

What does my policy cover me for?

You can check what your policy covers you for

by reading your membership pack,

which you would've received when you renewed

or when you took out your policy with us.

Or if you're in doubt about anything, just give us a call.

Where can I see what I am covered for?

You can view all of your policy information in your

membership pack, which will be sent out

to you in the post when you renew or shortly

after you join Bupa.

Can I add family members to my policy?

Yes. When your policy renews, you can add family members on.

Just give us a call and we'll talk you through this.

Can I speak to someone about my renewal?

We are here to help regarding the renewal process, so just give us a call.

If you've got any questions,

your policy will automatically renew if we don't hear from you.

Will speaking to someone put my price up next year?

Using our Anytime Healthline digital GP or Family Mental Healthline will not

affect your no claims discounts, as these aren't considered as claims.

If you make a claim though for treatment or therapies, et cetera,

then these will impact your no claims discount because you're claiming for these

services. If you do need to make a claim though, please don't defer.

Just to protect your no claims discount.

When or how do I pay my excess?

Bupa will let you know when you need to pay an excess on claims.

Don't pay anything to the healthcare provider until we instruct you to do so.

Can I make changes to my policy?

When you renew your policy, you can make changes.

That might be something like adding an excess, changing the excess amount,

changing the outpatient benefit limits, or adding a family member.

Why has my price increased?

Your price may increase if you've made claims in the policy year.

If you've moved your age and if you started smoking, for example.

There are many other reasons why your price may go up,

like the cost of treatment may just increase.

If there's anything you're unsure of, just give us a call.

If I want to cancel my policy who should I speak to?

We are more than happy to discuss your options if you want to cancel your

policy. Our helplines are open eight till eight, Monday to Friday,

or nine till 1230 on a Saturday. Please note calls may be recorded.

How can I make a complaint?

If you want to make a complaint about your Bupa policy,

please just reach out to us directly.

Full details on how to make a complaint can be found in your membership pack,

which you would've received when you joined us or when you renewed.

Will my price increase every year?

Most likely yes, because as you age,

the likelihood of you making a claim will go up. Also,

the cost of treatment will rise, which will have an impact on your price,

and therefore there will be an impact on your no claims discount. The.

What changes can I make at renewal?

You can change your policy options such as outpatient cover, hospital cover,

or review your access at renewal.

You can also choose to add or remove dependents if there's a preexisting

condition on your policy that we aren't covering you for. Then at renewal,

we may be able to review this for you.

Do I get a no claims discount?

You will have a no claims discount applied when you join us.

Then depending on if you have or haven't claimed your no claims discount may

be affected when you renew with us.

If you've got any questions regarding how the No Claims discount works,

just give us a call and we'll help you through it.

Can I cancel at anytime and will I be charged to do so?

You can absolutely cancel your policy at any time,

and there is no charge to do so.

Can I change my excess?

Yes, you can change your excess when your policy renews.

Excess amounts vary from zero to 2000 pounds.

If you're selecting a 1000 or a 2000 pounds excess,

you'll need to call us to go through this rather than doing a quote via the

website.

I'm not happy about my policy increasing in price, who should I speak to?

If you're not happy about your renewal price,

please reach out to us directly and we can talk you through your options moving

forward. Please just call this number.

Are there any rewards?

Yes, there are lots of rewards for being with Bupa to save you money on health,

leisure, and wellbeing. Just visit our website for more information.

Can I get help with my mental health?

Yes, you can reach out to our Anytime Healthline.

You can access the digital gp or you can view our website

where you'll find lots of expert content on many,

many mental health related topics.

If you do need treatments or need to book an appointment with someone,

we should be able to help you with this, depending on your levels of cover.

So give us a call and we should be able to help.

Is there a limit to the number of phone calls I can make to the Anytime HealthLine?

There are no limits to the amount of times you can call the Anytime Healthline.

They're available all year round,

anytime day or night to help with any health concerns that you may have.

Where can I find health advice?

Bupa's website at Bupa dot co.uk hosts a whole array of health

content and expert advice.

We have content from our health ambassadors and clinical expertise.

We also have our inside health content,

which will be delivered straight to your mailbox.

What's Anytime HealthLine?

In a nutshell,

it's a helpline stuffed by Bupa nurses who are available anytime

day or night to help with any health concerns that you may have,

big or small.

They're there to provide you with reassurance and guidance on the next steps.

Hopefully putting your mind at rest.

Where can I find out more about the person who is treating me?

You can use our finder tool at finder dot Bupa dot uk.

There, it will give you lots of information on different consultants,

their specialties, their location, their contact details,

and any other information you might want to know.

Need treatment? You don’t always need a GP referral

If you’re experiencing any of these symptoms, and your cover includes Direct Access, call us directly. You may be able to get treatment without a GP referral†.

If your issue is with something else, visit our ‘Get treatment’ page to see how to get help.

Get treatment

Getting an open referral

If you have a condition that requires a GP referral, we recommend you ask for an ‘Open Referral letter’. This will explain the care your GP would like you to have. But it will not be addressed to a specific consultant, hospital or healthcare professional.

The referral needs to include the type of speciality that you have been referred to.

We then aim to offer a choice of two or three specialists. If the first choice of consultant is unavailable, we can offer you an alternative. With an open referral, you can do this without having to return to your GP for a second referral.

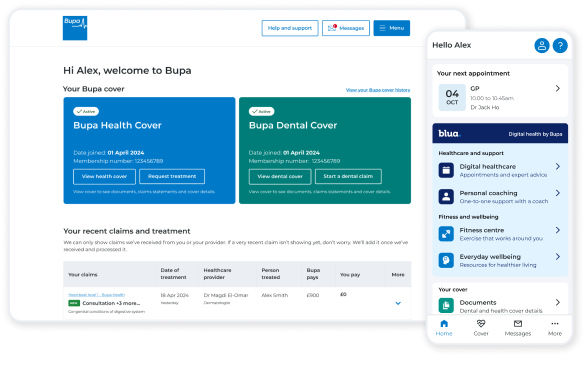

Your healthcare. All in one place

We’ve made it easier for you to manage your health and wellbeing with the My Bupa app. Access digital healthcare, find the right care and manage your account all in one place.

Speak to GPs, nurses, physios and mental health specialists. Book video or audio appointments during the day and evenings, on weekends or bank holidays.

You won’t be charged to use it digital healthcare, and it won’t affect your claims.

Talk to a nurse anytime of the day or night

Whether it’s late at night or first thing in the morning, our Anytime HealthLine is there for you. Just call to be connected to a nurse for clear and simple advice. Our nurses can help with:

- rashes, lumps and bumps

- surgery and back pain

- vomiting, diarrhoea and abdominal pain

- fever, flu, cough and headaches

- advice about sick children

Waiting for treatment?

Helping you get ready

We have a range of health information to support patients who are preparing for treatment. This includes advice from Bupa experts, about a range of conditions.

Need more advice?

Check out our guides for tips, advice and information. You can also read about health topics, such as looking after yourself as a parent and taking care of your children’s health.

How to choose health insurance

Lowering cost to choosing what's covered – here are the key things to know.

What does health insurance cover?

See what is and isn't usually covered by health insurance.

How much does health insurance cost?

Find out how much health insurance costs and what you get for your money.

Free, trusted health information from Bupa

See our library of conditions, treatments and healthy living advice.

Get a health insurance quote now

Our health insurance is designed to suit you. You can get a personalised quote by chatting to us and answering questions about your health and lifestyle.

Get a quote online

We’ll ask you some questions and you’ll get a personalised quote.

Call us

We may record or monitor our calls. Lines are open Monday to Friday 8am to 8pm.

Contact us

Got a question? Complete this quick form and we’ll get back to you soon.

† Any onward referrals for consultations, tests or treatment are subject to the benefits and exclusions of your cover. Please check your guide and certificate for further details or contact us to check your eligibility.

The My Bupa App is provided by Bupa Insurance Services Limited which is authorised and regulated by the Financial Conduct Authority (FCA). Registered in England and Wales at 1 Angel Court, London, EC2R 7HJ. Its company number is 3829851. VAT Registration Number: 239731641.

Bupa Digital GP services are provided by Bupa Occupational Health Limited. Registered in England and Wales with registration number 631336. Registered office: 1 Angel Court, London EC2R 7HJ.

Bupa Digital Services and Bupa Anytime HealthLine are not regulated by the Financial Conduct Authority or the Prudential Authority.

Anytime HealthLine is provided by Bupa Occupational Health Limited. Registered in England and Wales No. 631336. Registered office: 1 Angel Court, London, EC2R 7HJ.

Bupa health insurance is provided by Bupa Insurance Limited. Registered in England and Wales with registration number 3956433. Bupa Insurance Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Arranged and administered by Bupa Insurance Services Limited, which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales with registration number 3829851. Registered office: 1 Angel Court, London, EC2R 7HJ. © Bupa2025

Page last reviewed: 05/12/2024